irs tax levy calculator

See How Easy It Is. In short a tax levy is when the IRS legally seizes your property or your rights to property with the intent of selling it to satisfy your back taxes.

Advantages And Disadvantages Of Gst In Malaysia Financial Aid For College Mortgage Interest Tax Software

Ad Use our tax forgiveness calculator to estimate potential relief available.

. See if you Qualify for IRS Fresh Start Request Online. See if you Qualify for IRS Fresh Start Request Online. This IRS penalty and interest calculator provides accurate calculations for the failure to file failure to pay and accuracy-related.

Please pick two dates enter an amount owed to the IRS and click Calculate. The balance originated one year ago. A single taxpayer who is paid weekly and claims three dependents has 50290 exempt from levy.

Get Free Consult Quote. Immediately give the employee parts 2 3 4 and 5 of the wage levy. The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms 1040 or.

For employees withholding is the amount of federal income tax withheld from your paycheck. You will need a copy of all. Interest and any applicable penalties will continue to.

For employers and employees - Use the calculator to determine the correct withholding amount for wage garnishments. Owe IRS 10K-110K Back Taxes Check Eligibility. Instruct the employee to sign and return the Statement of Exemptions and Filing Status and return parts 3 and 4 to the.

Employers generally have at least one full pay period after receiving a notice of levy on wages. Ad Get Reliable Answers to Tax Questions Online. Ad Get A Quick Estimate On How Much You May Get Back Or Owe With Our Free Calculator.

A tax levy allows the IRS to legally take your property. Under this program the IRS can generally take up to 15 percent of your federal payments including Social Security or up to 100 percent of payments due to a vendor for. If you owe for multiple.

Usually the IRS will implement a. Levies are different from liens. Certified Public Accountants are Ready Now.

A levy is a legal seizure of your property to satisfy a tax debt. IRS Tax Levy Calculation. The IRS can levy or legally seize a taxpayers property to satisfy an outstanding back taxes.

Ad Apply for tax levy help now. Of course an IRS levy doesnt happen overnight. A tax levy is a legal seizure on wages to satisfy a tax debt.

When the levy is on a bank account the Internal Revenue Code IRC provides a 21-day waiting period for complying with the levy. What is the IRS tax levy calculation. Easily Calculate Your Tax Refund And Get Started On Filing Your Taxes.

Bloomberg Tax Expert Analysis Your Comprehensive Federal Tax Information Resource. Ad Stop Tax Levy. By using this site you agree to the use of cookies.

Click here to see this page in full context. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Tax changes as a result of the Tax Cuts and Jobs Act have altered the way.

Figures based on the Federal IRS. With a tax levy the IRS confiscates assets of yours such as the money in your savings account or a portion of your wages. If the taxpayer in number 1 is over 65 and writes 1 in the ADDITIONAL STANDARD.

What is the IRS tax levy calculation. Levy forms include a Total Amount Due This amount is calculated through the date shown below the total amount due. Trusted Affordable Reliable Professionals That Can Stop Your Tax Levy Today.

IRS Levies Expert Can Help. Bob owes 27000 to the IRS. Immediate Permanent Solutions.

We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. Ad Owe back tax 10K-200K. A tax levy is a.

Discover Helpful Information And Resources On Taxes From AARP. You were sent a tax bill for the amount owed Notice and. Ad Owe back tax 10K-200K.

Ad Get the Latest Federal Tax Developments. IRS Tax Levy Calculation. Information About Bank Levies.

A lien is a legal claim against property to secure payment of the tax debt while a. Typically this will happen only after the following three conditions are met. Get free competing quotes from leading IRS tax levy experts.

Get A Free IRS Tax Levy Consultation. I have an employee who has a 2100 tax levy as of 032007s notice. Dont Face the IRS Alone.

Using the calculation above Bobs minimum monthly payment is 375. Owe IRS 10K-110K Back Taxes Check Eligibility.

Irs Tax Attorney Call 619 639 3336 Irs Taxes Tax Attorney Attorneys

Tax Attorney Tax Attorney Tax Lawyer Tax Preparation

Online Sales Tax Compliance Ecommerce Guide For 2022

Tax Levy Understanding The Tax Levy A 15 Minute Guide

Example Of Loading Federal Tax Levy Involuntary Deductions For Us Employees

Taxes 2022 What To Do If You Haven T Filed Your Return Yet Youtube

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

Payroll Management Services Allow You To Take Your Human Resources Management To A Higher Level Effective Payroll Admin Payroll Software Payroll Taxes Payroll

State Corporate Income Tax Rates And Brackets Tax Foundation

Stop A Tax Levy At Ooraa Irs Taxes Tax Debt Tax Payment Plan

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

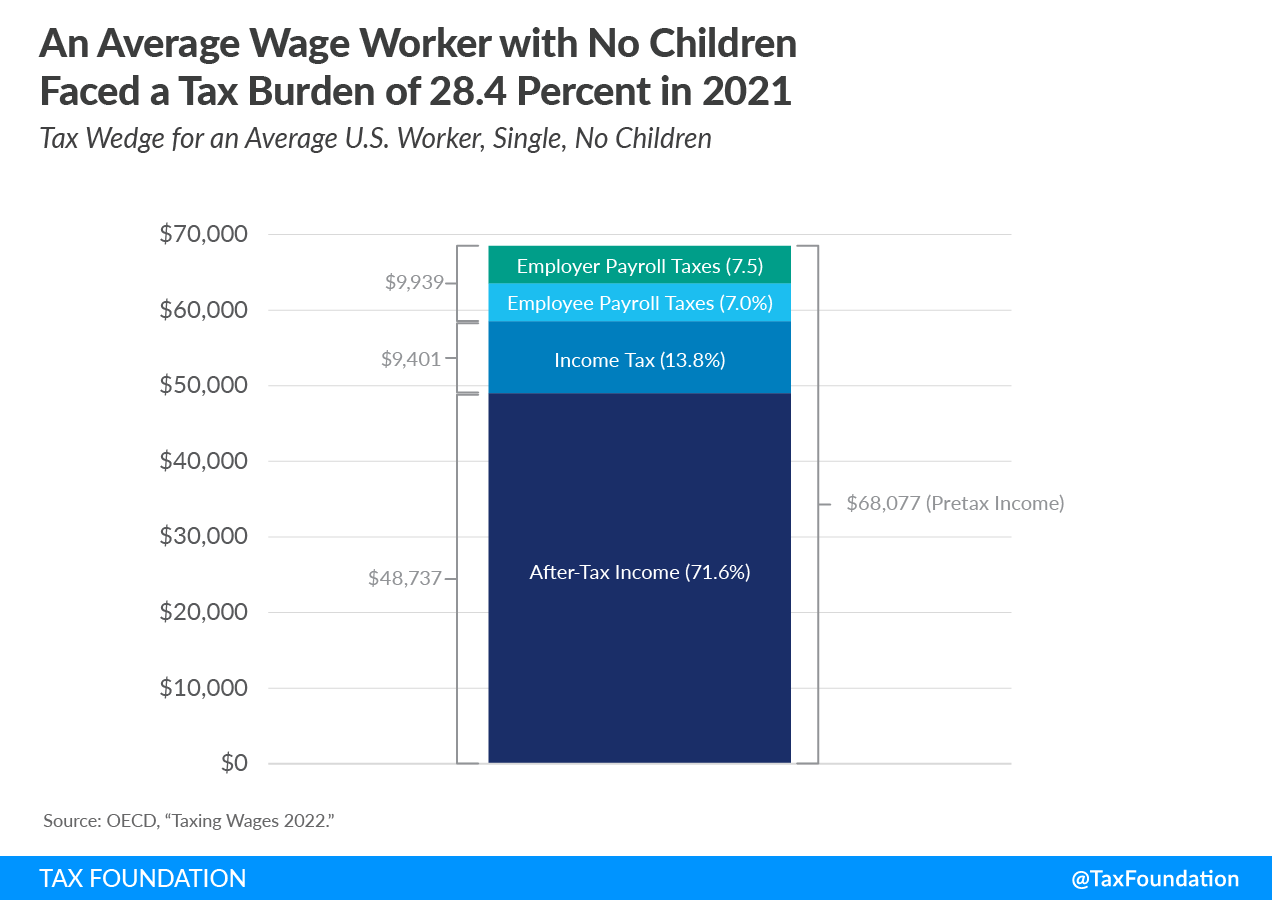

Tax Wedge Taxing Wages Details Analysis Tax Foundation

3 14 1 Imf Notice Review Internal Revenue Service

Tas Tax Tip Understanding Your Csed And The Time Irs Can Collect Taxes

:max_bytes(150000):strip_icc():gifv()/ScheduleK-1-final-6cc807d7884b4b2e8d15fe1867dad55c.png)

Schedule K 1 Federal Tax Form What Is It And Who Is It For

:max_bytes(150000):strip_icc()/taxes-4188113-final-1-650f90dd44bf47c1bf1fb75727a58565.png)

Taxes Definition Types Who Pays And Why

Payroll Taxes Here S A Breakdown Of What Gets Taken Out Of Your Pay And What You Are Taxed On Youtube

How To Find Out How Much You Owe In Irs Back Taxes Turbotax Tax Tips Videos